These tips for making college cheaper will help students pay for college, decrease tuition fees, and cut college costs. Not your usual “get a student credit card” and “get a roommate” tips!

These tips for making college cheaper will help students pay for college, decrease tuition fees, and cut college costs. Not your usual “get a student credit card” and “get a roommate” tips!

Tonya has a great question about paying for college:

“Hi Laurie, this is a good back to school list for college students, but what about how to pay for college? It costs so much to go to college and I don’t know how I’ll pay for the school supplies, much less ipads and tablets and laptops. How do I decrease the cost of college tuition and expenses? Thank you, Tonya.”

The best way to pay for college is to find a way to go for free. If you haven’t searched for college or university scholarships, what are you waiting for? I recently wrote an article about scholarships and bursaries – the link is at the end of this article.

In this article, I will:

- Briefly describe typical college costs

- Share the breakdown of my tuition expenses at UBC

- Explain how I decreased my tuition

- Discuss how to pay for college (10 ways to cut college costs)

Typical College Costs

Below is a list of my university fees. I’m getting my Master’s of Social Work at UBC (the University of British Columbia) – it’s a two year program for students who don’t have an undergrad degree in social work. When I went to the University of Alberta for my first two degrees, I never looked at my list of tuition fees. I just blindly paid the tuition – even though I couldn’t afford to pay for college without getting a student loan.

Have you looked at what your college costs each semester? Here’s my breakdown…

College Costs – Term 1

- Athletics and Recreation Fee $66.98

- AMS Membership Fee $21.74

- AMS Athletics and Intramurals $21.00

- Bike Kitchen $1.00

- Student Clubs Benefit Fund $1.55

- Childcare Bursary Fund $1.04

- Capital Improvement Fund $1.95

- CiTR Radio $5.18

- Student Spaces Fund $12.38

- Graduate Student Centre $17.21

- International Projects Fund $0.26

- Sustainability Projects Fund $2.33

- University/External Lobbying $4.14

- AMS/GSS Health & Dental Fee $218.66

- Ombudperson $1.01

- AMS Resource Groups $1.55

- Sexual Assault Support Fund $3.36

- AMS Student Services $7.25

- AMS Financial Assistance Fund $12.00

- Student Legal Fund $1.00

- SUB Renewal Fee $70.00

- Ubyssey Publication Fee $6.21

- UPass $140.00

- Student Refugee Fund $2.59

Total $2,096.44

College Costs – Term 2

- Athletics and Recreation Fee $66.98

- Capital Improvement Fund $1.95

- Graduate Student Centre $17.21

- UPass $140.00

Total $1,752.10

Last year, I cut my college costs by opting out of the health and dental fee. I was covered by my husband’s extended health insurance through his workplace, and all I needed to do to decrease my tuition by $218 was apply for an exemption.

10 Ways to Make College Cheaper

1. What college costs can you opt out of? At UBC a few years ago, there was a controversial debate about whether students should be allowed to opt out of the UPass (the monthly student bus pass that costs $140 per semester. It’s a huge cost of attending college!). I’m not thrilled to pay that much money for a bus pass I use twice a week, but I can’t opt out. Learning how to pay for college – and how to reduce college costs – is about looking carefully at your tuition fees and figuring out which ones are optional.

2. Use the college’s resources and supplies. If you have to pay all your college fees, then make sure you use every part of the campus! Work out at the college’s gym because you’re paying for it. Use the microwaves in the community spaces at college, because your tuition is covering the cost. Get counselling at through the campus health center, so you can stay healthy and happy. Find out what you’re paying for in your tuition fees, and squeeze every last drop out of your college experience. It’s not exactly how to pay for college, but it may help you save money on other aspects of life.

3. Graduate from college early. This is a brilliant tip on how to pay for college – I wish I’d thought of it! In College costs have some graduating early, the Northwest Herald reports on a student called Taylor Berge. She graduated a year early from Hope College – I’m assuming she completed her Bachelor of Science degree in psychology in three years instead of four. She’s also just two courses shy of a second degree in communicative disorders. But, the article warns that graduating from college early can be difficult without dual credit or Advanced Placement courses. Summer and evening courses can help cut college costs in the long run (though it may be more expensive and stressful to take extra college courses in the short run).

4. Learn where the highest college costs are. Learning how to pay for college tuition is one thing – but did you know that the price of housing and food is more expensive than college tuition costs? This is for students who attend public universities in their home states or provinces, according to a College Board survey. It’s not college tuition that’ll bankrupt you – it’s your housing and food. The good news is that you have control over much of your housing and food costs when you’re at college, depending on whether you live in the dorm or on your own.

5. Compare the cost of college dorms versus apartments. Here’s a great way to pay for college from Anna Orso in The Patriot News: “Many colleges require freshmen to live in university residence halls, but some don’t….Make sure you shop around before settling on a college dorm – you can often find a much better value in an apartment complex. Be sure to factor in things like utilities and how long the lease is, as many apartment buildings require a 12-month lease. That’s not ideal if you’re not planning on staying at school for the summer. Don’t settle on a dorm right away if you don’t have to. You could save a lot of money on college costs if you just look around and find what’s right for you and your budget.” – from 7 financial tips for college freshmen: back to school.

6. Negotiate your financial aid package. Here’s another great way to cut college costs, which I didn’t know about: “The majority of full-time students receive aid – nearly two-thirds got grants or scholarships in 2007-08, the most recent data available. Average amount: just over $7,000. Many colleges say awards are nonnegotiable. Colleges don’t like to use the word “negotiate,” but aid adjustments are not unusual, especially at private schools vying for top students.” – from How we cut college costs.

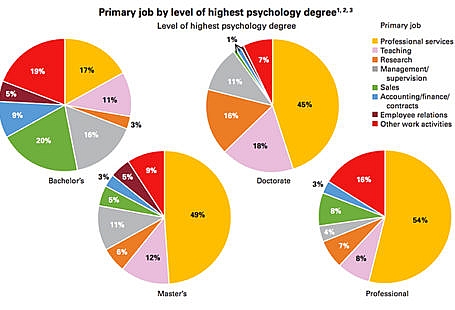

7. Think about your college major. In Picking college major comes down to money, I learned that college in the past was unique because students decided which college to attend before learning how much it would cost or whether they knew how to pay for college. “For the longest time, families were kind of ignoring the college cost. Now cost is often the deciding factor. A survey by Discover Student Loans found that nearly half of adults are limiting their child’s college choices based on price. And with rising student loan debt and a job market that continues to greet college grads with not-so-open arms, the ability to find employment has become a top factor in deciding what to study at college.

In How to Choose a College Major, I describe why I think it’s a mistake to choose a major based on the job market.

8. Make the IRS your BFF. Most of my blog traffic comes from the United States (even though I live and work in Vancouver, Canada!). So, here’s what the IRS says about cutting college costs and paying tuition: “Going to college can be a stressful time for students and parents. The IRS offers these tips about education tax benefits that can help offset some college costs and maybe relieve some of that stress.

- The American Opportunity Tax Credit can be up to $2,500 per eligible student. It’s available for the first four years of college, university, or other post secondary education. Forty percent of the credit is refundable. That means that you may be able to receive up to $1,000 of the credit as a refund, even if you don’t owe any taxes. Qualified expenses include tuition and fees, course related books, supplies and equipment. A recent law extended the AOTC through the end of Dec. 2017.

- The Lifetime Learning Credit allows you to claim up to $2,000 for qualified education expenses on your federal tax return. There is no limit on the number of years you can claim this credit for an eligible student.

If you’re a college student in Canada who wants to cut college costs by learning the tax credits and benefits offered by the Canadian government, please let me know below! I’m happy to research it for you.

9. Attend workshops on cutting college costs. The more you learn about how to pay for college, the cheaper it’ll be to go to school. Is there a local bank or credit union that offers workshops or seminars on cutting college costs? Does your college offer tips on how to decrease tuition? Is there a financial institution or personal financial planner nearby, who does seminars on paying college costs? Get as much information as you can, because one seminar or blog post on cutting college costs won’t give you all the info you need on paying for your education.

10. Research scholarships, bursaries, grants, and other ways to get free tuition. In Scholarships for Women Going Back to School, I describe the difference between a scholarship and a bursary, and list several different types of scholarships, grants, etc. It’s amazing what’s available, and how far even $500 can go towards paying for college and cutting costs.

Phew – it’s your turn! I welcome your comments on paying for college costs below. What have I missed?

If you’re a mature student, read about going back to college at 40.

2 comments On 10 Ways to Make College Cheaper

Here’s a tip on paying for college costs from a Facebook friend:

FAFSA, Grants, Scholarships – check out heritage related opportunities, military and even company offerings whether it’s yours or a parent’s. If you’re not sure about a major try pre reqs at a community college. If you’re working see if your company offers tuition reimbursement. I used Fast Web a million years ago but there are far better resources now.

Many states and banking institutions now offer college savings programs. Every little bit helps.

I paid for college with student loans and I agree with your article on the benefits of taking out student loans to pay fro college. But, now that I graduated, how do I pay off my student loans? Paying for college was the easy part. paying off loans is the hard part. 🙁 Any tips on that?