If you want to become a doctor, you don’t need a big brain, rich parents, or 20/20 vision. Here's what you really need, plus steps to becoming a doctor.

Blog Posts

Here are the health effects of journaling for breast cancer survivors who write about their deepest fears and the benefits of the diagnosis, plus tips for journaling.

Our friend’s mom was recently diagnosed with a cancerous tumour in her brain. These tips on how to help a friend whose mom has cancer are from him, and from an interesting news article I found.

How do you apply the Bible to your daily life, especially when life is painful or confusing? Check out these five practical tips for living Biblically in a modern world...

Here’s how I learned to play the flute without music lessons – I’m a self-taught flutist (flute player), and I’m the first to admit how frustrated and annoyed I get when I’m trying to learn new songs on the flute.

These ways to leave relationship abuse behind are for women in toxic, addictive relationships. They may know they’re not living their best life…but breaking up with an abusive partner is easier said than done.

Here's a creative way to combine two business ideas: offer life coaching services as you give manicures. In this life coach job description, you'll how a certified life and wellness coach also works as a professional manicurist.

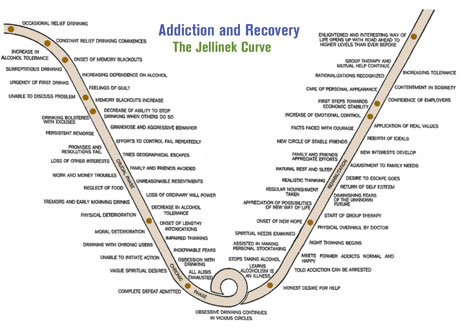

Many people wonder how alcoholism can be a disease, because drinking is a choice. Here is a simple explanation of alcoholism as a disease, based on a question from a reader whose sister is an alcoholic.

Here are the pros and cons of changing your name back to your maiden or family name after getting a divorce, plus tips on how to change your name.

You know breaking up was the right thing to do, but you feel guilty anyway. Here’s how to stop feeling guilty about the breakup and start healing. On my article about letting go of someone you love, a reader asked how she can stop feeling guilty about breaking up with her boyfriend of four years. Here are my suggestions, starting with a quotation from a strong woman in history. “This is all you have,” says Dr Laura Schlessinger. “This is not …

Deciding if it's time to put your dog to sleep is heart wrenching. Here's what a veterinarian says about making this decision for your dog and your family.

Is it the cook's first time cooking a turkey? These Thanksgiving gift ideas will help him or her host an inaugural Thanksgiving turkey dinner.

Whether you want to start a graphic design business or put a little “oomph” into the business you have, you can’t miss this job description! Here, a self-employed Vancouver-based graphic designer offers salary and career tips for aspiring designers. “The general public has a surprisingly low awareness of what communication designers do, exactly,” says Kathy Sigstad, who created Stringbean Design. “Everything in the natural world grows perfectly all on its own, but everything in the human world is shaped by the human mind and hand.” Sigstad …

These cremation urns range from pendants to green burial vessels. What I love about Artisurn (artist's urns) is the idea of healing through beauty and ashes. Here are several different types of cremation urns - including pendants that hold ashes - which were created with love by artisans who specialize in memorial resting places.

Had a not-good, terrible, horrible, bad day at work? These ways to pamper yourself at home will help you gather strength and energy to face tomorrow.