If you know how to produce positive energy, you will attract good things in life! These four law of attraction tips are based on The Secret, whichs holds that you send out negative and positive energy constantly. And, you attract what you emit. How, then, do you make sure you produce positive energy so you attract good things into your life? I have some ideas for you…but before we dive into my four tips for producing positive energy, check out this quip from Dr Joe Vitale: “Everything …

Blog Posts

The most successful bloggers always ask, "What is a good blog?" Here's a summary of the best tips from professional bloggers and Google gurus, to show you what a good blog is.

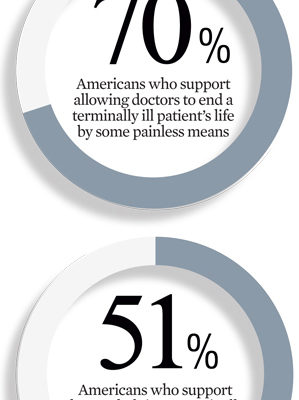

Here are three ways to describe what “death with dignity” is for people at the end of their lives – as well as for caregivers who love them, work with them, and support them in different ways.

Here's a list of jobs for introverts and quiet people, plus job search tips for introverted personality types. If you're an introvert, you're in the minority! But that doesn't mean it's "bad" to be an introvert...

A funeral director’s job involves helping people plan funeral services with compassion and empathy. In this career profile, a funeral director describes the challenges and rewards of working in a funeral home, and offers career tips for people interested in this caring profession. Sherry Varkel, an Ontario licensed funeral director since 1997, says that people are often surprised by the personalities of people in her field. “We all have good and positive attitudes,” she says. They need to in order …

Owning a costume rental shop is fun in many ways – and hard work in others! In this job description, a costume rental store owner describe the ups and downs of owning and managing a fancy dress shop. Most customers are surprised that you can get such a huge assortment of costumes in a rental shop – they can come in looking one way and walk out looking like Freddy Mercury, Shrek or Marilyn Monroe! For some customers, …

These five simple do-it-yourself dog massage techniques are from certified canine bodywork practitioners. I interviewed them for an article on pet massage I wrote last year for alive magazine in Vancouver.

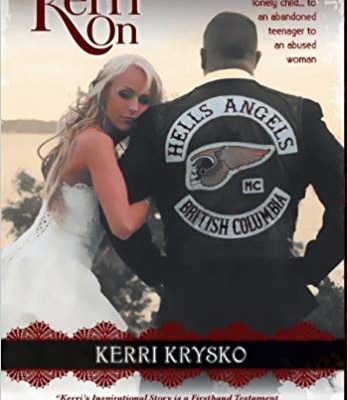

In this interview, author Kerri Krysko describes writing the first Hells Angels book, a self-published memoir about being a Hells Angels ex-wife, called Kerri On: A Memoir of a Hells Angels Ex-Wife.

How are other people's expectations holding you back? These five tips for letting go of expectations are based on inspiration from Maria Shriver,

Digging through a Christmas stocking stuffed with holiday surprises is the best part of Christmas morning! Here are two lists of creative Christmas stocking stuffer ideas: one for him, and one for her.

If you want to become a doctor, you don’t need a big brain, rich parents, or 20/20 vision. Here's what you really need, plus steps to becoming a doctor.

Here are the health effects of journaling for breast cancer survivors who write about their deepest fears and the benefits of the diagnosis, plus tips for journaling.

Our friend’s mom was recently diagnosed with a cancerous tumour in her brain. These tips on how to help a friend whose mom has cancer are from him, and from an interesting news article I found.

How do you apply the Bible to your daily life, especially when life is painful or confusing? Check out these five practical tips for living Biblically in a modern world...

Here’s how I learned to play the flute without music lessons – I’m a self-taught flutist (flute player), and I’m the first to admit how frustrated and annoyed I get when I’m trying to learn new songs on the flute.